There’s a growing divide in how Americans experience the economy and it's largely shaped by income.

Read More

You’ve probably heard some version of this advice: “Wait until 70 to claim Social Security. You’ll get the biggest check.”

Read More

Inflation has been the boogeyman of the economy for months.

Sticky prices. Rising gas costs. A looming rate hike.

The latest report provided useful data for

You’ve probably seen the headlines: the U.S. government has shut down again. It is the kind of story that dominates the news cycle, stirs up anxiety, and makes

Read More

The Federal Reserve recently trimmed interest rates for the first time this year.

Read More

Borrowing costs. Savings. Investments. All three can be affected by one key player: the Federal Reserve.

Read More

The Fed is sending up a flare: the economy may be softening.

Read More

What if I told you the economy is slowing… yet investors are cheering? Sounds backward, right? But it is happening in plain sight.

Read More

Here’s a stat that stops a lot of people in their tracks: Less than 4% of all U.S. stocks have been responsible for the market’s net gains going back nearly 100

Read More

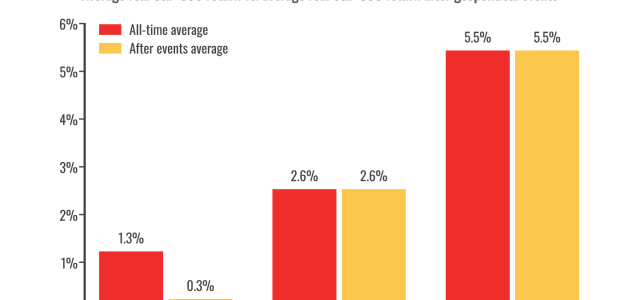

After a surprise Israeli strike on Persian nuclear and military targets, Iran fired back with missile attacks of their own.

Read More

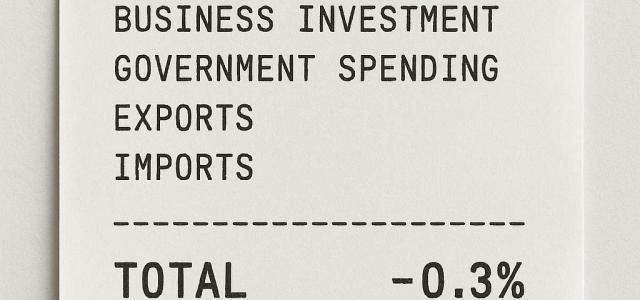

GDP dipped...but not for the reason you think.

Read More

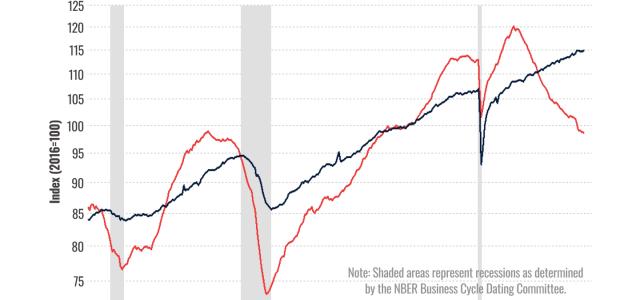

Markets have been on a roller coaster, and investors are asking:

Is a bear market on the way?

Read More